PicoCELA Inc. (PCLA)

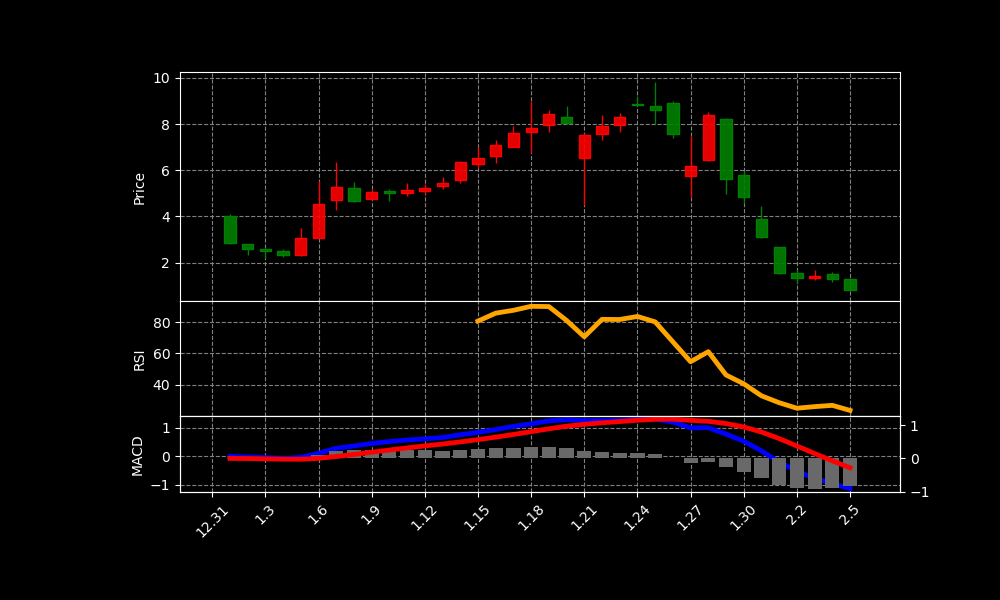

PCLA Chart as of 2025-03-10

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 53 |

| Address: | SANOS Building, Tokyo, Japan |

| Country: | Japan |

| Website: | https://picocela.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 0.8299999833106995 USD |

| Today Change: | -35.16% |

| Outstanding Shares: | 24,683,900 |

| Volume: | 829,918 |

| Avg Volume: | 1,402,697 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Dr. Hiroshi Furukawa | CEO & Representative Director | — | — |

| Mr. Hideaki Horikiri | CFO & Director | — | — |

| Mr. Toshihito Kanai | CTO & Director | — | — |

| Mr. Kosuke Nakanishi | Head of Corporate Affairs | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 784,403,000 |

| Cost Of Revenue | 361,202,000 |

| Gross Profit | 423,201,000 |

| Operating Income | -447,184,000 |

| Net Income | -479,921,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 1,234,753,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

No news from NewsAPI

Analysis of Today’s Move

**Stock Price Decline: A Lack of Information**

The absence of any news from NewsAPI indicates a lack of readily available positive or negative catalysts. This informational vacuum can lead to uncertainty among investors. Uncertainty often translates into selling pressure, driving the stock price downward. A lack of news makes assessing company performance difficult.

The SEC filing summary’s “No CIK found” message is particularly concerning. This implies the company is either newly formed or not properly registered with the SEC. Such a lack of regulatory compliance raises serious red flags for investors. It suggests potential issues with transparency and financial reporting.

The combination of these two factors, the lack of news and the SEC filing anomaly, offers a plausible explanation for the stock’s fall. Investors may be reacting to perceived risk due to inadequate information. They are likely wary of potential undisclosed problems. The lack of SEC filings further compounds the issue.

Without clear financial data or positive news releases, speculation fills the void. This speculation, especially when coupled with regulatory questions, can turn negative. Investors are likely choosing to exit their positions rather than risk further losses. Prudent investors prefer companies with robust public information.

Therefore, the lack of readily available information and the SEC filing issue strongly suggest that the stock price decline is driven by investor apprehension. Until the company addresses these concerns, the downward trend may continue. Addressing transparency is crucial for restoring investor confidence. Further investigation into the company’s regulatory status is warranted.

This stock has shown a change of -35.16% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.