Sonoma Pharmaceuticals, Inc. (SNOA)

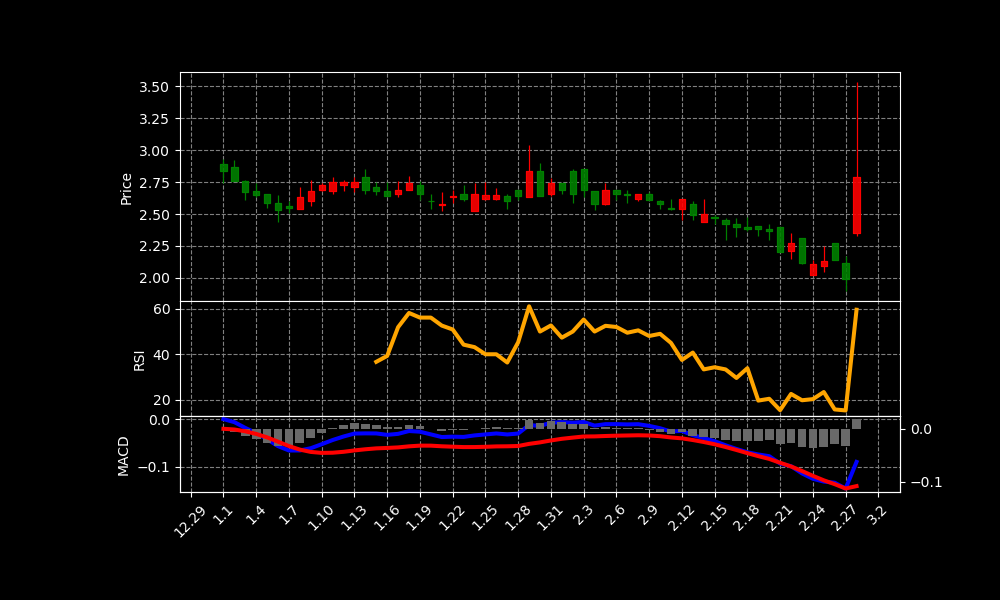

SNOA Chart as of 2025-03-11

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 10 |

| Address: | 5445 Conestoga Court, Boulder, CO, United States |

| Country: | United States |

| Website: | https://sonomapharma.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 3.51 USD |

| Today Change: | 25.81% |

| Outstanding Shares: | 1,615,760 |

| Volume: | 34,908,163 |

| Avg Volume: | 677,200 |

| Expert Target Price: | 17.0000 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | 2019-06-20 |

| Last Split Date: | 2024-08-30 |

| Last Split Factor: | 1:20 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Ms. Amy M. Trombly J.D. | CEO, President & Director | 608.82k | — |

| Mr. Jerome J. Dvonch CPA | Chief Financial Officer | 268.79k | — |

| Mr. Bruce Thornton | Executive VP, COO & Corporate Secretary | 540.94k | — |

| Mr. John Dal Poggetto | Controller | 433.36k | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 12,735,000 |

| Cost Of Revenue | 7,990,000 |

| Gross Profit | 4,745,000 |

| Operating Income | -4,701,000 |

| Net Income | -4,835,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 14,740,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001683168-25-000736 | 2025-02-05 | Sonoma Pharmaceuticals’ Q3 2025 10-Q filing (false) includes financial data for periods ending 2023/03-2024/12. Key items: Common Stock, APIC, Retained Earnings, AOCI, Stock Options, Restricted Stock, and Insurance Premium Financing. Also includes Equity Distribution Agreement. |

| 0001683168-25-000611 | 2025-01-30 | Sonoma Pharma (SNOA) filed an 8-K on 1/29/25, reporting a material supply agreement with WellSpring for Microcyn products. The 2-year agreement has automatic renewal options. The filing includes forward-looking statements and associated risks. |

| 0001683168-25-000084 | 2025-01-03 | SEC Form 4 filing by Bruce Thornton, Executive VP & COO of Sonoma Pharmaceuticals (SNOA), on 01/02/2025. It reports changes in beneficial ownership of securities. The filing indicates direct ownership and may involve a 10b5-1 trading plan. |

| 0001683168-25-000083 | 2025-01-03 | Form 4 filing for Sonoma Pharmaceuticals (SNOA) by director Jay E Birnbaum. Earliest transaction date: 01/02/2025. Form indicates changes in beneficial ownership of securities. |

| 0001683168-25-000082 | 2025-01-03 | SEC Form 4 filing for Sonoma Pharmaceuticals (SNOA) by Director John McLaughlin. Reports changes in beneficial ownership of securities, pursuant to Section 16(a). Earliest transaction date: 01/02/2025. |

News Summary

– Sonoma Pharmaceuticals (SNOA) to Release Earnings on Thursday

2025-02-11 07:36:44 | ETF Daily News

Sonoma Pharmaceuticals (NASDAQ:SNOA – Get Free Report) will likely be posting its quarterly earnings results before the market opens on Thursday, February 13th. Analysts expect Sonoma Pharmaceuticals to post earnings of ($0.80) per share and revenue of $4.39 …

Link

Analysis of Today’s Move

**Sonoma Pharmaceuticals (SNOA) Stock Rally Analysis**

Sonoma Pharmaceuticals’ stock experienced a rally today, likely driven by a combination of factors. The anticipation of upcoming earnings, coupled with recent positive developments, may have fueled investor optimism. The earnings release scheduled for Thursday, February 13th, is undoubtedly a key factor. Investors are likely positioning themselves ahead of the announcement.

The expected earnings per share (EPS) is projected to be a loss of $0.80. Revenue estimates stand at $4.39 million. Despite the anticipated loss, positive news regarding supply agreements could be influencing sentiment. The recent material supply agreement with WellSpring is noteworthy.

The 8-K filing from January 29th highlighted a 2-year agreement. This agreement is for the supply of Microcyn products. The agreement includes automatic renewal options. This indicates potential long-term revenue stability for Sonoma Pharmaceuticals.

Furthermore, recent Form 4 filings revealed changes in beneficial ownership by executives and directors. These filings often signal insider confidence in the company’s future prospects. Bruce Thornton, Jay E Birnbaum, and John McLaughlin all reported changes. These filings add to the positive sentiment surrounding the stock.

In conclusion, the rally in Sonoma Pharmaceuticals’ stock today can be attributed to a confluence of factors. These factors include the upcoming earnings release, a new material supply agreement, and insider activity. Investors appear to be betting on a positive outlook for the company. This is despite the expected loss per share being reported on Thursday.

This stock has shown a change of 25.81% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.