Hesai Group (HSAI)

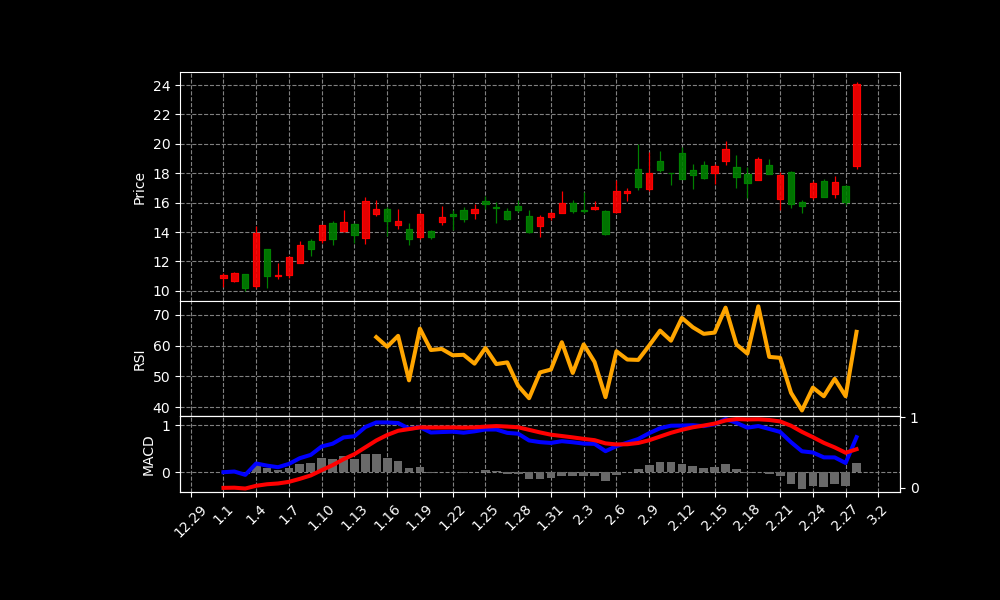

HSAI Chart as of 2025-03-11

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | – |

| Address: | Building A, Shanghai, China |

| Country: | China |

| Website: | https://www.hesaitech.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 24.079999923706055 USD |

| Today Change: | 30.16% |

| Outstanding Shares: | 97,445,000 |

| Volume: | 26,579,029 |

| Avg Volume: | 3,371,665 |

| Expert Target Price: | 18.0611 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Dr. Yifan Li | Co-Founder, CEO & Director | — | — |

| Dr. Kai Sun | Co-Founder, Chief Scientist & Director | — | — |

| Mr. Shaoqing Xiang | Co-Founder, CTO & Director | — | — |

| Mr. Peng Fan | Chief Financial Officer | — | — |

| Yuanting Shi | Investor Relations Director | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 1,876,989,000 |

| Cost Of Revenue | 1,215,611,000 |

| Gross Profit | 661,378,000 |

| Operating Income | -571,591,000 |

| Net Income | -475,968,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 5,662,543,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– Hesai Group (HSAI) Projected to Post Earnings on Monday

2025-03-09 07:16:56 | ETF Daily News

Hesai Group (NASDAQ:HSAI – Get Free Report) will likely be issuing its quarterly earnings data after the market closes on Monday, March 10th. Analysts expect the company to announce earnings of $1.42 per share and revenue of $723.60 million.

Link

– Hesai Group (NASDAQ:HSAI) Hits New 12-Month High – Time to Buy?

2025-02-23 08:22:51 | ETF Daily News

Shares of Hesai Group (NASDAQ:HSAI – Get Free Report) hit a new 52-week high during trading on Friday. The company traded as high as $20.18 and last traded at $19.65. The stock had previously closed at $18.51.

Link

– Hesai Group to Report Fourth Quarter and Full Year 2024 Financial Results on Monday, March 10, 2025

2025-02-18 11:00:00 | GlobeNewswire

– Earnings Call Scheduled for 9:00 PM ET on March 10, 2025 – – Earnings Call Scheduled for 9:00 PM ET on March 10, 2025 –

Link

– Hesai Group Reports Fourth Quarter and Full Year 2024 Unaudited Financial Results

2025-03-10 21:00:00 | GlobeNewswire

Quarterly net revenues were RMB719.8 million (US$98.6 million)1Quarterly lidar shipments were 222,054 unitsFull Year 2024 net revenues were RMB2,077.2 million (US$284.6 million)Full Year 2024 lidar shipments were 501,889 units

Link

Analysis of Today’s Move

Hesai Group (HSAI) experienced a stock rally today following its earnings report. The company announced its fourth quarter and full year 2024 financial results after market close. Anticipation of these results had already driven the stock to a new 52-week high. The market likely reacted positively to the actual figures released. These financials offered insight into the company’s recent performance.

The key driver behind the rally appears to be strong revenue figures and lidar shipments. Fourth quarter net revenues reached RMB719.8 million (US$98.6 million). Lidar shipments for the quarter totaled 222,054 units. Full year 2024 net revenues were RMB2,077.2 million (US$284.6 million). The company shipped 501,889 lidar units throughout 2024.

These numbers demonstrate substantial growth in Hesai’s core business. Analysts had projected earnings of $1.42 per share and revenue of $723.60 million. While the exact EPS figure is not provided in the summary, revenue nearly matched the expected projection. The growth in lidar shipments likely boosted investor confidence. This confidence translated directly into increased buying pressure.

It’s important to note that these are unaudited results. The market’s reaction may moderate as more details are released. An earnings call is scheduled for 9:00 PM ET, potentially providing further insights. Investors will likely be listening for commentary on future guidance. Management’s tone and forecasts will significantly impact future stock performance.

In conclusion, the rally seems primarily fueled by strong revenue and shipment figures. While no SEC filings were available, the unaudited financial results provide a clear catalyst. The market’s initial reaction is optimistic. Further analysis following the earnings call will be necessary to assess the long-term impact.

This stock has shown a change of 30.16% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.