OptimizeRx Corporation (OPRX)

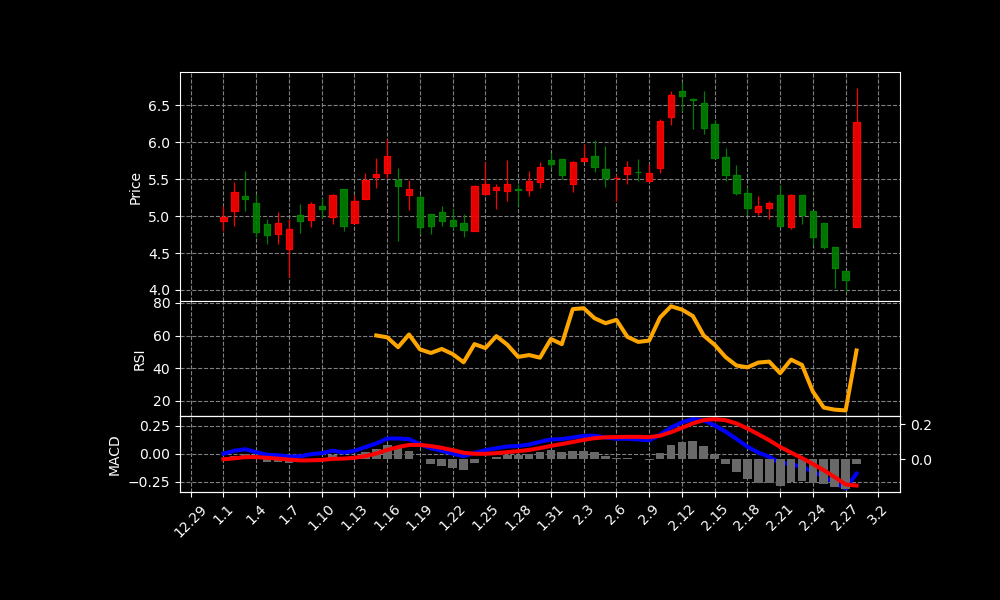

OPRX Chart as of 2025-03-12

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 135 |

| Address: | 260 Charles Street, Waltham, MA, United States |

| Country: | United States |

| Website: | https://www.optimizerx.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 6.28000020980835 USD |

| Today Change: | 29.48% |

| Outstanding Shares: | 18,420,900 |

| Volume: | 16,373,961 |

| Avg Volume: | 458,289 |

| Expert Target Price: | 9.7143 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | 2018-05-14 |

| Last Split Date: | 2018-05-14 |

| Last Split Factor: | 1:3 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Edward Stelmakh C.M.A., M.B.A. | CFO & COO | 626.74k | — |

| Mr. Andrew Jacob D’Silva | Senior Vice President of Corporate Finance | — | — |

| Ms. Marion K Odence-Ford | General Counsel & Chief Compliance Officer | 428.12k | — |

| Ms. Maira Alejandra | Media Relations Manager | — | — |

| Ms. Sheryl Kearney | Human Resources Manager | — | — |

| Mr. Terence J. Hamilton | Senior Vice President of Pharma | 441.63k | — |

| Dr. Doug Besch | Chief Product Officer | — | — |

| Ms. Theresa Greco | Chief Commercial Officer | — | — |

| Ms. Heather Favazza | Controller | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 71,521,506 |

| Cost Of Revenue | 28,621,589 |

| Gross Profit | 42,899,917 |

| Operating Income | -17,521,815 |

| Net Income | -17,565,866 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 183,373,898 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001213900-25-022947 | 2025-03-12 | OptimizeRx (OPRX) filed an 8-K on March 12, 2025, reporting financial results for Q4 and FY 2024 and initial 2025 guidance (Item 2.02). Exhibit 99.1 is the press release. |

| 0001213900-25-022445 | 2025-03-11 | OptimizeRx files soliciting material for its 2025 annual stockholder meeting. Proxy materials, including a WHITE proxy card, will be filed with the SEC. Stockholders are urged to read these materials for important information. Participants in the proxy solicitation are identified, and their interests will be detailed in the Proxy Statement. |

| 0001193125-25-051186 | 2025-03-11 | Whetstone Capital is soliciting proxies to elect Andrew Carlson and John Fein to OptimizeRx’s board at the 2025 annual meeting. Whetstone and related parties beneficially own 1,508,303 shares of OptimizeRx common stock. Shareholders are advised to read the proxy statement. |

| 0000950170-25-036537 | 2025-03-10 | CSS styling for textboxes and tables. Defines borders, fonts, colors, alignment, and wrapping. Sets properties for various table elements (th, td) and states (e.g., NoBorder, Valign). |

| 0001213900-25-021923 | 2025-03-10 | OptimizeRx (OPRX) 8-K filing on March 10, 2025, reports Stephen Silvestro’s appointment as CEO. He was previously President and interim CEO. His annual base salary is $500,000, plus bonus and equity. A press release was issued. |

News Summary

– OptimizeRx (OPRX) Expected to Announce Earnings on Wednesday

2025-03-10 07:05:12 | ETF Daily News

OptimizeRx (NASDAQ:OPRX – Get Free Report) will likely be posting its quarterly earnings results before the market opens on March 12th. Analysts expect OptimizeRx to post earnings of $0.25 per share and revenue of $30.36 million.

Link

– Brokerages Set OptimizeRx Co. (NASDAQ:OPRX) Price Target at $9.06

2025-02-25 06:08:48 | ETF Daily News

OptimizeRx Co. (NASDAQ:OPRX – Get Free Report) has been assigned a consensus recommendation of “Moderate Buy” from the nine brokerages that are presently covering the firm, MarketBeat reports. Three research analysts have rated the stock with a hold recommend…

Link

– OptimizeRx Corporation Confirms Receipt of Notice of Director Nominations

2025-03-11 11:30:00 | GlobeNewswire

No Stockholder Action Required at this Time No Stockholder Action Required at this Time

Link

– OptimizeRx Corporation Appoints Stephen Silvestro as Chief Executive Officer

2025-03-10 11:30:00 | GlobeNewswire

Silvestro has a demonstrated record of accelerating revenue growth, expanding brand relevance, and building a market-leading team Silvestro has a demonstrated record of accelerating revenue growth, expanding brand relevance, and building a market-leading team

Link

Analysis of Today’s Move

OptimizeRx (OPRX) experienced a notable stock rally today. Several factors appear to have contributed to this positive market reaction. The announcement of a new CEO with a proven track record is a key driver. The expected earnings announcement also creates anticipation among investors.

The appointment of Stephen Silvestro as CEO is a significant catalyst. His demonstrated ability to accelerate revenue growth is encouraging. Silvestro’s experience in expanding brand relevance is also viewed positively. These factors signal a potentially stronger future for the company.

The imminent Q4 and FY 2024 earnings release adds to the optimism. Analysts anticipate earnings of $0.25 per share. Projected revenue stands at $30.36 million for the quarter. Exceeding these estimates could further fuel the stock’s upward momentum.

Brokerage firms’ positive outlook contributes to investor confidence. A consensus “Moderate Buy” recommendation suggests overall bullish sentiment. The average price target of $9.06 indicates potential upside. These factors further incentivize investors to buy and hold OPRX shares.

Finally, although the director nomination notice initially seemed concerning, the company stated “No Stockholder Action Required.” Whetstone Capital’s proxy solicitation may not pose an immediate threat. This allows investors to focus on the positive catalysts. The stock rallied as these factors outweighed any boardroom uncertainty.

This stock has shown a change of 29.48% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.