LZ Technology Holdings Limited Class B Ordinary Shares (LZMH)

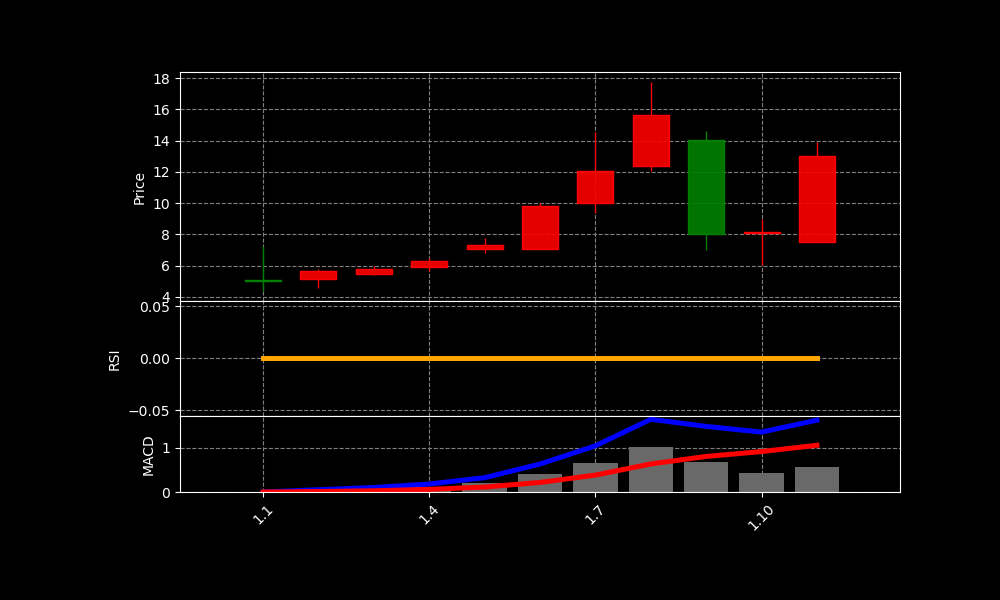

LZMH Chart as of 2025-03-13

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 67 |

| Address: | No. 5999 Wuxing Avenue, Zhili Town, Huzhou, China |

| Country: | China |

| Website: | https://lz-qs.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 13.010000228881836 USD |

| Today Change: | 73.42% |

| Outstanding Shares: | 129,300,000 |

| Volume: | 838,793 |

| Avg Volume: | 841,090 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Runzhe Zhang | CEO & Director | — | — |

| Ms. Weihua Chen | Chief Financial Officer | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 568,865,000 |

| Cost Of Revenue | 537,609,000 |

| Gross Profit | 31,256,000 |

| Operating Income | -6,439,000 |

| Net Income | -6,209,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 286,139,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– Why LZ Technology Holdings Limited Class B Ordinary Shares (LZMH) Soared Last Week

2025-03-09 22:47:20 | Yahoo Entertainment

– LZ Technology Holdings (LZMH) Plans to Raise $9 Million in February 27th IPO

2025-02-15 06:14:49 | ETF Daily News

LZ Technology Holdings (LZMH) plans to raise $9 million in an initial public offering (IPO) on February 27th. The company will be issuing 1,800,000 shares at a price of $4.00-$6.00 per share. In the last 12 months, LZ Technology H…

Link

– LZ Technology Holdings Limited Announces Underwriters’ Full Exercise of Over-Allotment Option

2025-03-11 20:30:00 | GlobeNewswire

HUZHOU CITY, China, March 11, 2025 (GLOBE NEWSWIRE) — LZ Technology Holdings Limited (NASDAQ: LZMH) (“LZ Technology” or the “Company”), an information technology and advertising company, today announced the underwriters of its initial public offering (the “O…

Link

– LZ Technology Holdings Limited Announces Pricing of Initial Public Offering

2025-02-27 01:00:00 | GlobeNewswire

HUZHOU, China, Feb. 26, 2025 (GLOBE NEWSWIRE) — LZ Technology Holdings Limited (“LZ Technology” or the “Company”), an information technology and advertising company, today announced the pricing of its initial public offering of 1,800,000 Class B ordinary sha…

Link

Analysis of Today’s Move

LZ Technology Holdings (LZMH) experienced a stock rally today. This surge appears directly linked to recent announcements. The underwriters’ full exercise of the over-allotment option is a primary driver. This suggests strong initial demand for the offered shares. Increased demand tends to push the stock price higher.

The over-allotment exercise indicates the IPO was well-received. The company’s IPO involved 1,800,000 Class B ordinary shares. These shares were initially priced between $4.00 and $6.00. The exercise of the option reinforces positive market sentiment. This suggests investors are optimistic about LZ Technology’s future.

Furthermore, the company operates in the information technology and advertising sector. This sector is currently experiencing rapid growth. This growth may attract investors seeking exposure. The combination of a successful IPO and sector appeal fueled the rally. The IPO itself occurred on February 27th.

The rally also benefits from last week’s unexplained surge. This prior rise in value created additional momentum. The market now perceives LZMH as a potentially high-growth stock. News of the IPO pricing itself was announced February 26th. All this together creates a complex picture.

In conclusion, the stock’s strong performance stems from several factors. The successful IPO, over-allotment exercise, and sector appeal are key. Prior gains contribute to the positive momentum. Investors clearly have confidence in LZ Technology’s prospects. Therefore, the rally is a confluence of these events.

This stock has shown a change of 73.42% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.