Mineralys Therapeutics, Inc. (MLYS)

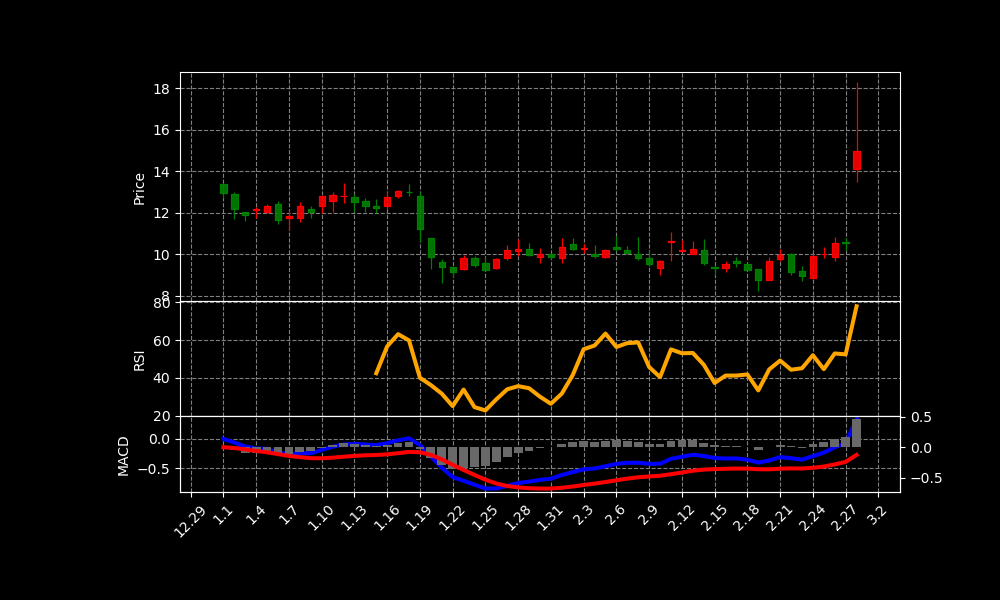

MLYS Chart as of 2025-03-10

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 51 |

| Address: | 150 N. Radnor Chester Rd., Radnor, PA, United States |

| Country: | United States |

| Website: | https://mineralystx.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 14.960000038146973 USD |

| Today Change: | 5.87% |

| Outstanding Shares: | 49,835,600 |

| Volume: | 15,069,270 |

| Avg Volume: | 283,155 |

| Expert Target Price: | 34.8571 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Jon Congleton | CEO & Director | 775.77k | — |

| Dr. Brian Taylor Slingsby M.D., M.P.H., Ph.D. | Founder & Executive Director | 69.33k | — |

| Mr. Adam Scott Levy | CFO & Secretary | 655.58k | — |

| Dr. David M. Rodman M.D. | Chief Medical Officer | 726.95k | — |

| Ms. Cindy Berejikian | Executive Vice President of Operations | — | — |

| Ms. Sarah Foster | Vice President of Human Resources | — | — |

| Dr. Robert McKean Ph.D. | Senior Vice President of CMC | — | — |

| Ms. Danielle Bradbury | Senior Vice President of Quality Assurance | — | — |

| Mr. Jeffrey N. Fellows | Senior Vice President of Regulatory Affairs | — | — |

| Ms. Jessica Ibbitson | Senior Vice President of Clinical Operations | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 0 |

| Cost Of Revenue | – |

| Gross Profit | – |

| Operating Income | -192,403,000 |

| Net Income | -177,810,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 205,903,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– Guggenheim Reaffirms “Buy” Rating for Mineralys Therapeutics (NASDAQ:MLYS)

2025-02-26 07:42:53 | ETF Daily News

Mineralys Therapeutics (NASDAQ:MLYS – Get Free Report)‘s stock had its “buy” rating reaffirmed by stock analysts at Guggenheim in a note issued to investors on Monday,Benzinga reports. Several other brokerages have also recently issued reports on MLYS. HC Wai…

Link

– Mineralys Therapeutics to Announce Topline Data from Launch-HTN and Advance-HTN Pivotal Trials Monday, March 10, 2025, at 8:00 AM ET

2025-03-07 21:01:00 | GlobeNewswire

RADNOR, Pa., March 07, 2025 (GLOBE NEWSWIRE) — Mineralys Therapeutics, Inc. (NASDAQ: MLYS), a clinical-stage biopharmaceutical company focused on developing medicines to target hypertension, chronic kidney disease (CKD), obstructive sleep apnea (OSA) and oth…

Link

– Mineralys Therapeutics (NASDAQ:MLYS) Shares Gap Down After Analyst Downgrade

2025-02-15 06:14:49 | ETF Daily News

Goldman Sachs Group lowered their price target on the stock from $28.00 to $24.00. The stock had previously closed at $10.63, according to the latest figures.

Link

– Mineralys Therapeutics (NASDAQ:MLYS) Price Target Cut to $24.00 by Analysts at The Goldman Sachs Group

2025-02-15 07:40:54 | ETF Daily News

Goldman Sachs Group cut Mineralys Therapeutics (NASDAQ:MLYS) from $28.00 to $24.00 in a research note issued to investors on Thursday. The firm presently has a “buy” ra…

Link

– Mineralys Therapeutics (NASDAQ:MLYS) Earns Buy Rating from HC Wainwright

2025-02-15 08:30:46 | ETF Daily News

mineralys Therapeutics (NASDAQ:MLYS)’s stock had its “buy” rating reaffirmed by stock analysts at HC Wainwright. They currently have a $30.00 target price on the stock.

Link

Analysis of Today’s Rally

Mineralys Therapeutics (MLYS) experienced a stock rally today driven primarily by positive analyst sentiment. Guggenheim reaffirmed its “buy” rating, boosting investor confidence. This positive signal countered earlier news of a price target reduction by Goldman Sachs. However, Goldman Sachs still maintains a “buy” rating.

The upcoming announcement of topline data significantly influences the stock. Mineralys will release pivotal trial results on March 10, 2025. These trials, Launch-HTN and Advance-HTN, are crucial for future growth. Positive data could validate Mineralys’ drug development pipeline.

The focus on hypertension and related diseases also plays a role. Mineralys targets chronic kidney disease and obstructive sleep apnea. The company’s potential impact on these large markets is significant. This justifies the “buy” ratings from multiple firms.

However, the absence of relevant SEC filings is somewhat concerning. Investors rely on these filings for company insights. The lack of a CIK further complicates detailed analysis. Therefore, reliance on news summaries becomes even more critical.

Overall, the rally likely stems from a confluence of factors. Analyst reaffirmations, especially Guggenheim and HC Wainwright, are key. Anticipation of positive trial results is also a factor. Investors should carefully monitor the March 10th data release.

This stock has shown a change of 5.87% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.