Zymeworks Inc. (ZYME)

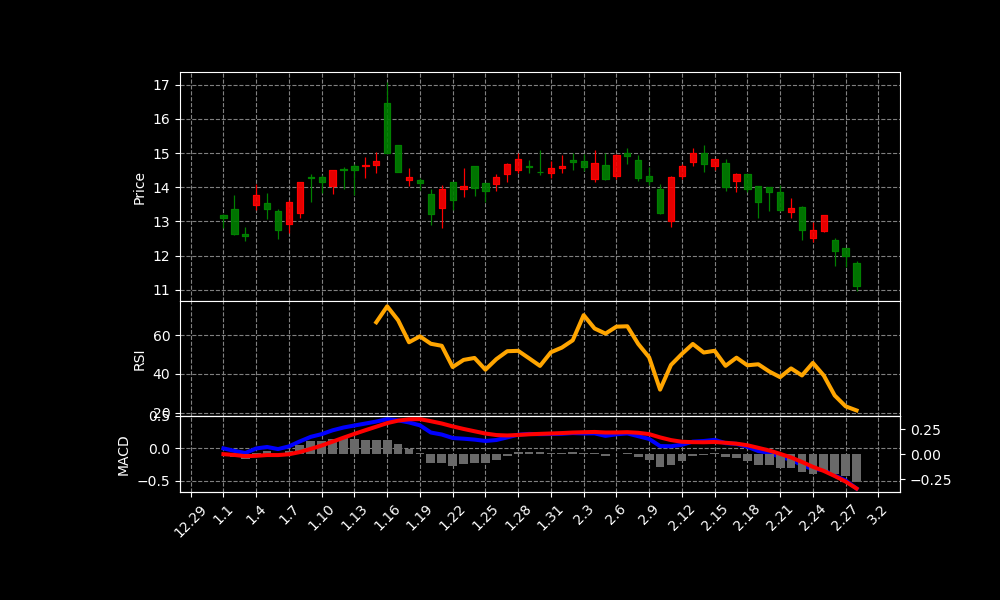

ZYME Chart as of 2025-03-11

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 280 |

| Address: | 108 Patriot Drive, Middletown, DE, United States |

| Country: | United States |

| Website: | https://www.zymeworks.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 6.0 USD |

| Today Change: | -45.95% |

| Outstanding Shares: | 69,576,896 |

| Volume: | 1,105,268 |

| Avg Volume: | 495,332 |

| Expert Target Price: | 19.7222 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Kenneth H. Galbraith C.A. | Chairman of the Board, CEO & President | 1.16M | — |

| Dr. Paul A. Moore Ph.D. | Chief Scientific Officer | 757.5k | — |

| Mr. Mark Hollywood | Executive VP and Head of Technical & Manufacturing Operations | — | — |

| Ms. Shrinal Inamdar | Director of Investor Relations | — | — |

| Mr. Daniel Dex J.D., Ph.D. | Senior VP, Corporate Secretary & General Counsel | — | — |

| Diana Papove | Senior Manager of Corporate Communications | — | — |

| Dr. Lindsey Foulkes B.Sc., Ph.D. | Vice President of Corporate Development | — | — |

| Ms. Laura O’Connor | Vice President of Human Resources & DEI | — | — |

| Dr. Jeffrey Smith M.D. | Executive VP & Chief Medical Officer | — | — |

| Mr. John Fann Ph.D. | Senior Vice President of Process Sciences | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 76,304,000 |

| Cost Of Revenue | – |

| Gross Profit | – |

| Operating Income | -119,817,000 |

| Net Income | -122,695,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 463,091,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0000070858-23-000084 | 2023-02-14 | Bank of America’s 13G/A filing for Zymeworks Inc. common stock (CUSIP 98985W102) as of 12/31/22. They report 0 shares beneficially owned, representing 0.0% of the class. They are filing to report ownership of less than 5%. |

| 0000846087-23-000035 | 2023-02-06 | Wellington Management Group filed a 13G/A amendment for Zymeworks Inc. (CUSIP 98985W102) common stock on 12/30/22, reporting 0 shares beneficially owned. They are filing under Rule 13d-1(b) as a parent holding company. |

| 0000899243-22-035785 | 2022-11-14 | Form 4 filing for Zymeworks BC Inc. [ZYME] by Neil Josephson (Chief Medical Officer). Reports transactions on 11/10/2022 including stock acquired via option exercise and disposed of via sale. Resulting direct ownership is 14,449 shares. |

| 0001193125-22-267073 | 2022-10-24 | Zymeworks BC Inc. files Form 15 to terminate registration under Section 12(g) of the Securities Exchange Act due to a corporate redomicile. Zymeworks Delaware Inc. is now the ultimate parent company and successor issuer, assuming reporting obligations. |

| 0001193125-22-266764 | 2022-10-21 | Zymeworks BC Inc. filed an 8-K on 10/21/22 reporting an Open Market Sale Agreement with Jefferies LLC to sell common stock. They may also file a Form 15 to terminate registration of shares/rights and suspend reporting duties. |

News Summary

– Zymeworks (ZYME) Expected to Announce Earnings on Wednesday

2025-02-26 08:48:56 | ETF Daily News

Zymeworks (NYSE:ZYME – Get Free Report) is expected to be announcing its earnings results after the market closes on Wednesday, March 5th. Analysts expect the company to announce earnings of $0.01 per share and revenue of $45.20 million for the quarter.

Link

– Zymeworks Announces Appointment of Oleg Nodelman to Board of Directors

2025-02-18 11:02:57 | Financial Post

VANCOUVER, British Columbia, Feb. 18, 2025 (GLOBE NEWSWIRE) — Zymeworks Inc. (Nasdaq: ZYME), a clinical-stage biotechnology company developing a diverse pipeline of novel, multifunctional biotherapeutics to improve the standard of care for difficult-to-treat …

Link

– Zymeworks Announces Participation in Upcoming Investor Conferences

2025-02-25 11:02:29 | Financial Post

VANCOUVER, British Columbia, Feb. 25, 2025 (GLOBE NEWSWIRE) — Zymeworks Inc. (Nasdaq: ZYME), a clinical-stage biotechnology company developing a diverse pipeline of novel, multifunctional biotherapeutics to improve the standard of care for difficult-to-treat …

Link

– Citigroup Forecasts Strong Price Appreciation for Zymeworks (NYSE:ZYME) Stock

2025-03-10 06:44:48 | ETF Daily News

Zymeworks (NYSE:ZYME – Free Report) had its target price raised by Citigroup from $18.00 to $19.00 in a report released on Friday morning. Citigroup currently has a buy rating on the stock.

Link

– Zymeworks To Report Fourth Quarter and Full Year 2024 Financial Results and Host Conference Call on March 5, 2025

2025-02-13 11:00:42 | Financial Post

VANCOUVER, British Columbia, Feb. 13, 2025 (GLOBE NEWSWIRE) — Zymeworks Inc. (Nasdaq: ZYME), a clinical-stage biotechnology company developing a diverse pipeline of novel, multifunctional biotherapeutics to improve the standard of care for difficult-to-treat …

Link

Analysis of Today’s Move

**Zymeworks Stock Price Decline Analysis**

The recent stock price decrease for Zymeworks (ZYME) requires a multifaceted explanation. Upcoming earnings expectations, while seemingly positive, can trigger volatility. Investors may be reacting to broader market trends or sector-specific anxieties. Profit-taking after Citigroup’s price target increase could also contribute.

The provided news lacks definitive negative catalysts for today’s drop. The announced board appointment and investor conference participation are typically neutral events. Anticipation surrounding the March 5th earnings call introduces uncertainty. Disappointment or revised guidance can quickly negatively influence investors.

Reviewing the SEC filings provides further context, although older. Several 13G/A filings from early 2023 show decreased institutional ownership. Bank of America and Wellington Management Group both reported owning zero shares. This reduced institutional support from a while ago adds to long term concerns.

The 2022 filings point to a corporate redomicile and stock sales. Zymeworks BC Inc.’s Form 15 details the termination of registration under Section 12(g). The Open Market Sale Agreement with Jefferies LLC further diluted share value. This previous activity might influence current investor sentiment.

In conclusion, the stock’s fall likely stems from a combination of factors. Earnings uncertainty, profit-taking after positive analyst coverage, and historical dilutions play roles. Lingering impacts of past corporate restructuring and institutional ownership shifts add to concerns. Further analysis post-earnings call is needed for complete insights.

This stock has shown a change of -45.95% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.