LifeMD, Inc. (LFMD)

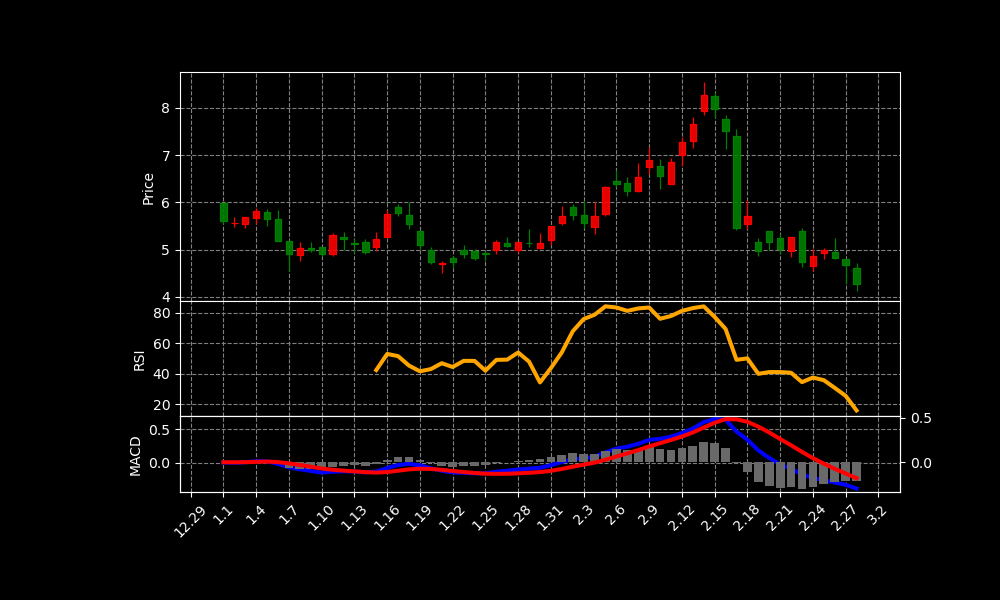

LFMD Chart as of 2025-03-11

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | – |

| Address: | 236 Fifth Avenue, New York, NY, United States |

| Country: | United States |

| Website: | https://lifemd.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 5.2 USD |

| Today Change: | 21.78% |

| Outstanding Shares: | 42,190,900 |

| Volume: | 3,033,893 |

| Avg Volume: | 986,312 |

| Expert Target Price: | 11.7222 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | 2020-10-14 |

| Last Split Date: | 2020-10-14 |

| Last Split Factor: | 1:5 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Justin Schreiber | Chairman & CEO | 533.8k | — |

| Mr. Marc Benathen | Chief Financial Officer | 608.73k | — |

| Mr. Stefan Galluppi | Chief Innovation Officer | 585.28k | — |

| Ms. Maria E. Stan CPA | Chief Accounting Officer | — | — |

| Mr. Dennis Wijnker | Chief Technology Officer | — | — |

| Mr. Eric H. Yecies | Chief Legal Officer, General Counsel & Secretary | 332k | — |

| Mr. Shane Biffar | Chief Compliance Officer & Deputy General Counsel | — | — |

| Ms. Jessica Friedeman | Chief Marketing Officer | — | — |

| Mr. Nicholas P. Alvarez | Chief Acquisition Officer & Head of Customer Acquisition | 141.11k | — |

| Mr. Varun Pathak | Chief Software Engineer & Co-Founder of PDF Simpli | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 152,547,006 |

| Cost Of Revenue | 18,900,464 |

| Gross Profit | 133,646,542 |

| Operating Income | -14,489,273 |

| Net Income | -20,595,992 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 58,480,709 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001493152-25-009690 | 2025-03-10 | LifeMD, Inc. (LFMD) filed an 8-K report on March 10, 2025, announcing its financial results for Q4 and year-end 2024, and providing earnings guidance for 2025 (Exhibit 99.1). |

| 0000912282-25-000265 | 2025-03-10 | SEC Form 4 filing by Stefan Galluppi, Chief Innovation Officer of LifeMD, Inc. (LFMD), reports a transaction on 03/06/2025 involving Common Shares. 60,000 shares were acquired, resulting in 105,449 shares beneficially owned. |

| 0000912282-25-000197 | 2025-02-26 | Form 3: Initial statement of beneficial ownership for LifeMD, Inc. (LFMD) filed by Shane Biffar, Chief Compliance Officer, on 02/19/2025. Reports direct ownership of 150,000 common stock shares. |

| 0000912282-25-000195 | 2025-02-21 | Form 4 filing by Justin Schreiber (LifeMD CEO, Director) on 02/14/2025, reporting the disposition of 50,000 shares of common stock at $7.5524, leaving 2,653,715 shares beneficially owned. Transaction per Rule 10b5-1(c). |

| 0001493152-25-001956 | 2025-01-13 | LifeMD, Inc. filed an S-8 to register 450,000 common shares for issuance under its equity plan. The filing also includes a reoffer prospectus for 1,751,529 shares of common stock offered by selling stockholders (employees, officers, directors) |

News Summary

– LifeMD to Report Fourth Quarter 2024 Financial Results on March 10

2025-02-25 13:05:00 | GlobeNewswire

LifeMD, Inc. (Nasdaq: LFMD) announces that it will report financial results for the three and 12 months ended December 31, 2024. LifeMD is a leading provider of virtual primary care services.

Link

– Brokerages Set LifeMD, Inc. (NASDAQ:LFMD) PT at $11.14

2025-02-15 07:12:50 | ETF Daily News

LifeMD, Inc. (NASDAQ:LFMD) has received an average recommendation of “Moderate Buy” from the seven research firms that are currently covering the firm. One equities research analyst has rated the stock with a hold recomme…

Link

– LifeMD® Announces Entry Into the Behavioral Health Market

2025-02-24 13:05:00 | GlobeNewswire

Expansion to Include Teletherapy, Psychiatry and Medication Management Behavioral Health Offering to be Led by Industry Veteran Julian Cohen NEW…

Link

Analysis of Today’s Move

LifeMD’s stock likely rallied today due to a combination of positive factors. The upcoming Q4 2024 earnings report, scheduled for release on March 10th, generates anticipation. Investors often buy ahead of earnings, hoping for positive surprises. Brokerages also set an average price target of $11.14 for LFMD.

The “Moderate Buy” recommendation further fuels investor optimism. LifeMD’s recent expansion into the behavioral health market is also a significant catalyst. The launch of teletherapy, psychiatry, and medication management services promises growth. This expansion, led by industry veteran Julian Cohen, signals strategic diversification.

An SEC Form 4 filing, showcasing insider buying, boosts confidence. Stefan Galluppi, LifeMD’s Chief Innovation Officer, acquired 60,000 shares. This acquisition shows internal confidence in the company’s future prospects. Such a purchase often signals a belief in the stock’s undervaluation.

However, other SEC filings present a mixed picture. CEO Justin Schreiber sold 50,000 shares earlier in February. This sale, though under a pre-arranged 10b5-1 plan, could temper enthusiasm slightly. The S-8 filing revealing a reoffer prospectus might create dilution fears.

Despite the CEO’s sale and the share reoffer, the positive news outweighed the negative. The behavioral health expansion, brokerage targets, and insider buying likely drove the rally. Investors appear focused on the growth potential and earnings anticipation. Continued positive news flow will be crucial to sustain this momentum.

This stock has shown a change of 21.78% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.