Bluejay Diagnostics, Inc. (BJDX)

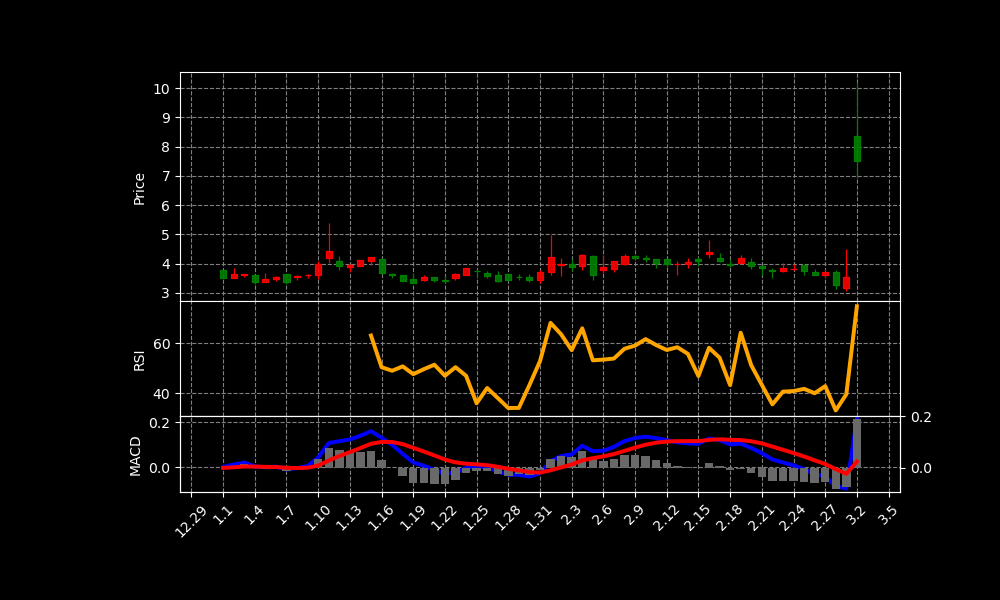

BJDX Chart as of 2025-04-07

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 10 |

| Address: | 360 Massachusetts Avenue, Acton, MA, United States |

| Country: | United States |

| Website: | https://bluejaydx.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 7.5 USD |

| Today Change: | -10.39% |

| Outstanding Shares: | 552,854 |

| Volume: | 58,289,798 |

| Avg Volume: | 71,146 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | 2024-11-18 |

| Last Split Factor: | 1:50 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Indranil Dey | Principal Financial, Accounting & Executive Officer, President, CEO and Director | 292.15k | — |

| Dr. Jason Cook | Chief Technology Officer | 240.29k | — |

| Mr. Les DeLuca | Vice President of Operations | — | — |

| Mr. Kevin Vance | Chief Commercial Officer | — | — |

| Mark W. Feinberg | Chief Medical Advisor | — | — |

| Dr. Mark W. Feinberg M.D. | Chief Medical Advisor | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 0 |

| Cost Of Revenue | nan |

| Gross Profit | nan |

| Operating Income | -7,169,616 |

| Net Income | -7,717,794 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 6,657,423 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001213900-25-026275 | 2025-03-31 | Bluejay Diagnostics (BJDX) files 10-K for year ended 12/31/24. They are a smaller reporting & emerging growth company. Common stock trades on Nasdaq. |

| 0001079973-25-000272 | 2025-02-14 | This SEC filing excerpt defines CSS styles for tables and textboxes. It specifies borders, padding, fonts, colors, and alignment for various table elements. |

| 0000950170-25-020689 | 2025-02-14 | This SEC filing text defines CSS styles for formatting textboxes and tables. It specifies borders, padding, font sizes, colors, alignment, and word wrapping for various table elements. |

| 0001535610-25-000015 | 2025-01-03 | The filing defines CSS styles for text boxes and tables. The styles specify borders, padding, font size/color, and word wrapping for various table elements (th, td) to format data presentation. |

| 0001213900-24-105693 | 2024-12-04 | Bluejay Diagnostics (BJDX) filed an 8-K on December 3, 2024, reporting Nasdaq confirmed they regained compliance with the minimum bid price rule (Listing Rule 5550(a)(2)). The deficiency matter, disclosed on March 4, 2024, is now closed. |

News Summary

– Short Interest in Bluejay Diagnostics, Inc. (NASDAQ:BJDX) Increases By 98.7%

2025-03-16 06:39:08 | ETF Daily News

Bluejay Diagnostics, Inc. (NASDAQ:BJDX) saw a large growth in short interest in the month of February. As of February 28th, there was short interest totalling 30,000 shares. Cu…

Link

– Bluejay Diagnostics, Inc. (NASDAQ:BJDX) Sees Large Drop in Short Interest

2025-03-27 07:24:54 | ETF Daily News

Bluejay Diagnostics, Inc. (NASDAQ:BJDX) was the recipient of a large drop in short interest in March. As of March 15th, there was short interest totalling 6,000 shares, a drop of 80.0%. Approxima…

Link

Analysis of Today’s Move

**Bluejay Diagnostics Stock Analysis: Potential Factors Behind Today’s Drop**

Bluejay Diagnostics (BJDX) stock performance is complex and warrants careful examination. Recent news reveals conflicting trends in short interest activity. February saw a significant increase in short interest, rising by a substantial 98.7%. This indicated a growing number of investors betting against the company.

However, March witnessed a dramatic reversal, with short interest plummeting by 80%. This suggests a potential shift in investor sentiment or short covering activity. The timing of these shifts alongside the annual 10-K filing is noteworthy. The 10-K filing on March 31st provides a comprehensive look at the company’s performance.

The 10-K filing may have contained information that negatively impacted investor confidence. This could include disappointing financial results or a less optimistic outlook. Investors may have reacted negatively, driving down the stock price following the filing. The reduced short interest does not necessarily negate the impact.

Furthermore, BJDX’s status as a smaller reporting and emerging growth company matters. These companies are often more volatile and susceptible to market fluctuations. News of non-compliance from December 2024 shows previous trouble. The stock drop could be caused by increased concern from investors.

Ultimately, the stock’s decline is likely a result of several converging factors. The annual 10-K filing served as a catalyst, releasing vital information. Combined with prior issues like Nasdaq minimum bid compliance, this likely led to investor anxiety. Future reports and company announcements will be crucial. Analyzing these will provide further insights into BJDX’s trajectory.

This stock has shown a change of -10.39% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.