CervoMed Inc. (CRVO)

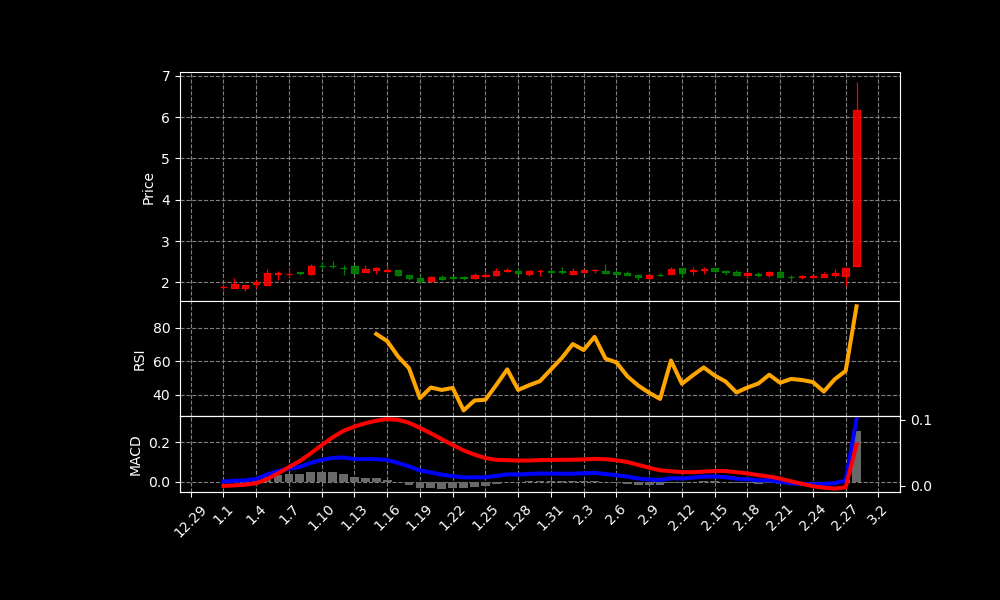

CRVO Chart as of 2025-03-12

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 8 |

| Address: | 20 Park Plaza, Boston, MA, United States |

| Country: | United States |

| Website: | https://www.cervomed.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 6.170000076293945 USD |

| Today Change: | 157.08% |

| Outstanding Shares: | 8,253,740 |

| Volume: | 153,926,783 |

| Avg Volume: | 2,939,834 |

| Expert Target Price: | 13.4000 (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | 2018-12-14 |

| Last Split Date: | 2023-08-17 |

| Last Split Factor: | 2:3 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Dr. John J. Alam M.D. | Co-Founder, CEO, President & Director | 680.25k | — |

| Dr. Sylvie L. Gregoire Pharm.D. | Co-Founder & Director | 352.43k | — |

| Mr. William Robert Elder J.D. | CFO & General Counsel | 407.55k | — |

| Dr. Robert J. Cobuzzi Jr., Ph.D. | COO & Director | 386.6k | — |

| Ms. Kelly Blackburn M.H.A. | Senior Vice President of Clinical Development | 404.94k | — |

| Dr. Mark A. De Rosch Ph.D. | SVP of Regulatory & Government Affairs & Program Management | — | — |

| Dr. Claudia Ordonez M.D. | Senior Vice President of Medical Science | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 0 |

| Cost Of Revenue | – |

| Gross Profit | – |

| Operating Income | -7,812,895 |

| Net Income | -2,171,873 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 9,972,521 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– CervoMed Inc. (NASDAQ:CRVO) Given Average Recommendation of “Hold” by Analysts

2025-02-15 07:12:49 | ETF Daily News

CervoMed Inc. (NASDAQ:CRVO – Get Free Report) has been assigned an average recommendation of “Hold” from the eight brokerages that are presently covering the stock, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell recommendat…

Link

– Analysts Set CervoMed Inc. (NASDAQ:CRVO) PT at $37.43

2025-03-10 05:05:04 | ETF Daily News

CervoMed Inc. (NASDAQ:CRVO) has been assigned an average rating of “Moderate Buy” from the eight ratings firms that are covering the stock. One analyst has rated the stock with a sell recommendation, three …

Link

– CervoMed Announces Positive Results from the Extension Phase of its Phase 2b Clinical Study of Neflamapimod in Patients with Dementia with Lewy Bodies

2025-03-10 20:05:00 | GlobeNewswire

A new batch of neflamapimod capsules led to increased plasma drug concentrations and demonstrated improvement (p<0.001 vs. old capsules; p=0.003 vs.......

Link

Analysis of Today’s Move

CervoMed (CRVO) shares likely rallied today due to positive clinical trial results. The company announced positive findings from the extension phase of its Phase 2b study. This study focused on Neflamapimod for Dementia with Lewy Bodies. The results showed improved plasma drug concentrations with a new capsule batch. This positive news outweighed prior analyst ratings.

The positive results showed significant improvement (p<0.001). This was when compared to old capsules. Results were also significant (p=0.003) when compared to baseline. This data suggests potential efficacy for Neflamapimod. The market is responding favorably to this development. Investors are optimistic about the drug's future prospects. Prior to this announcement, analyst sentiment was mixed. The average recommendation was a "Hold" according to reports. The average price target was recently set at $37.43. These ratings likely did not fully reflect the potential. The significant clinical progress has shifted market perception. The lack of recent SEC filings is noteworthy. This means that there has been no recent trading activity. This could mean that the good news was unexpected. This may indicate that there are no insider sales taking place. This reinforces the positive market sentiment. In conclusion, the rally is primarily driven by the clinical trial success. Neflamapimod's potential in treating Dementia with Lewy Bodies is now clearer. The market sees this as a significant value driver. This is outweighing prior analyst opinions. The absence of notable SEC filings further supports a positive outlook.

This stock has shown a change of 157.08% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.