Chanson International Holding (CHSN)

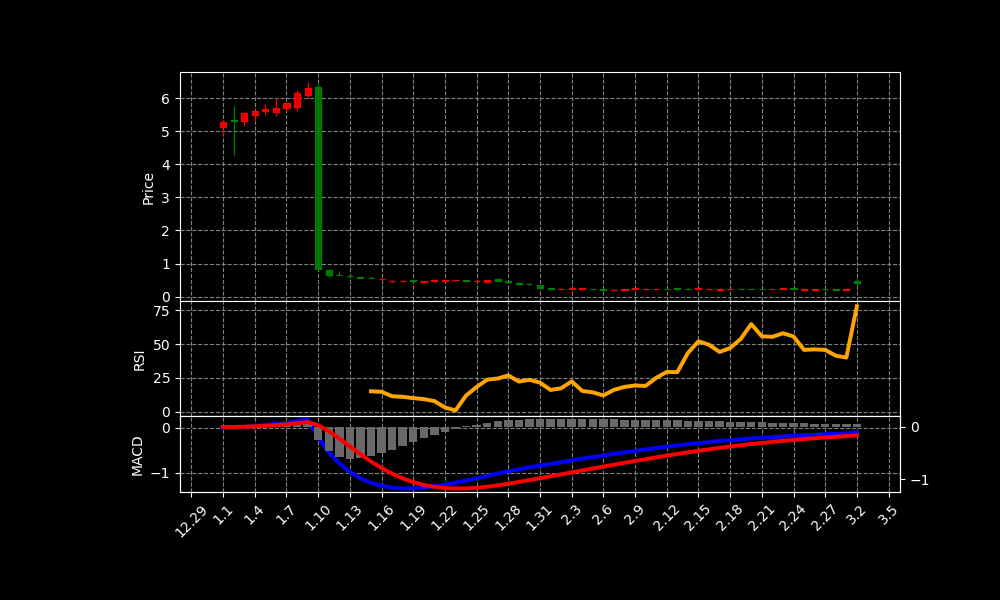

CHSN Chart as of 2025-04-07

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 410 |

| Address: | No. 26 Culture Road, Urumqi, China |

| Country: | China |

| Website: | https://ir.chanson-international.net |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 0.41600000858306885 USD |

| Today Change: | -12.88% |

| Outstanding Shares: | 21,629,700 |

| Volume: | 160,184,660 |

| Avg Volume: | 2,395,248 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Gang Li | Chairman of the Board & CEO | — | — |

| Ms. Jihong Cai | Chief Financial Officer | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 17,252,662 |

| Cost Of Revenue | 9,105,337 |

| Gross Profit | 8,147,325 |

| Operating Income | -610,501 |

| Net Income | 33,588 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 38,434,296 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001213900-25-028989 | 2025-04-04 | Chanson International Holding’s 2024 annual report (Form 20-F). Shares (CHSN) registered on Nasdaq. 21,629,707 Class A and 5,670,000 Class B shares outstanding. Not a large accelerated filer, an emerging growth company. Uses U.S. GAAP. |

| 0001213900-25-024401 | 2025-03-17 | Chanson International Holding held an EGM on March 12, 2025. Shareholders approved increasing authorized share capital, adopting an amended memorandum, and a share consolidation plan (250:1 or lower). The board retains discretion on consolidation details. |

| 0001213900-25-023694 | 2025-03-13 | Chanson Int’l Holding (China) filed a 6-K, reporting Nasdaq notice (3/10/25) that it doesn’t meet min. $1 bid price. Co. has until 9/8/25 to regain compliance. Delisting possible if not. Evaluating options. (Press release included). |

| 0001213900-25-016089 | 2025-02-21 | Chanson International Holding (Cayman Islands) filed a 6-K report in Feb 2025 regarding its upcoming Extraordinary General Meeting (EGM) on March 10, 2025. Included are the EGM notice/proxy statement and proxy card. |

| 0001213900-24-113160 | 2024-12-27 | Chanson International Holding held an EGM and AGM on Dec 26, 2024. The EGM approved increasing Class B share voting rights. The AGM re-elected Gang Li, Yong Du, Jie Li, and Shuaiheng Zhang as directors. |

News Summary

– NHL streaming options: Untangling the 2024-2025 mess

2025-04-01 17:00:00 | PCWorld

NHL teams are moving to streaming services. The streaming situation looks just as complicated as baseball was over the summer. As pay TV subscriptions decline and the regional sports business model collapses, NHL teams aremoving.

Link

– Every NBA streaming option in one place

2025-03-27 17:00:00 | PCWorld

In 2025, all but one NBA team offers standalone streaming options, allowing you to watch in-market games without an expe… Just like with hockey and baseball, your options for watching local NBA games this year can vary drastically based on where you live.

Link

– Michigan Sportswatch Daily Listings

2025-04-04 15:35:34 | Yahoo Entertainment

Big Ten Plus Ball State at Eastern Michigan — ESPN+, ESPN app Michigan at Oregon — Big Ten Plus Chicago at Detroit — CHSN, FDSN Detroit, Fubo Sports US…

Link

– DirecTV offering Chicago sports fans new $19.99 streaming package to get both CHSN and Marquee in time for opening day

2025-03-13 12:32:33 | Biztoc.com

There is still no carriage agreement for the fledgling Chicago Sports Network to air on Comcast. Opening day for the White Sox is two weeks away. 1 million pay-TV viewers in the city and suburbs will be blacked out.

Link

– When is MLB Opening Day? Yankees-Brewers kick off the season. See schedule, how to watch

2025-03-27 11:02:39 | Austin American-Statesman

Opening Day for Major League Baseball is approaching. Here’s the schedule with dates, times and how to watch.

Link

Analysis of Today’s Move

Chanson International Holding (CHSN) likely experienced a stock decline today due to multiple factors. Recent SEC filings highlight significant concerns about the company’s financial health and future. Specifically, the Nasdaq notification regarding the minimum bid price deficiency is a major red flag. Failure to regain compliance by September 8, 2025, could lead to delisting.

The potential delisting from Nasdaq creates substantial uncertainty for investors. This uncertainty often triggers a sell-off as investors seek to avoid losses. The proposed share consolidation plan, while intended to boost the share price, also reflects underlying issues. These issues indicate that the company requires measures to avoid delisting.

The SEC filings detail previous actions that could be viewed as attempts to manipulate share value. The approved increase in authorized share capital may dilute existing shareholders. Changes to Class B share voting rights could also influence company control. These factors can erode investor confidence and negatively impact the stock.

Furthermore, the news articles, although not directly related to Chanson, paint a concerning backdrop. The articles reveal a fragmented and complex sports streaming landscape. This situation could impact CHSN if they are involved in related broadcasting ventures. This is because the fragmented market could indicate a challenging environment for media companies.

In conclusion, the stock’s decline today is likely attributed to the Nasdaq compliance issue. The risk of delisting, combined with the share consolidation plan, created selling pressure. Investor concerns were likely compounded by general market uncertainty. This uncertainty included the complicated sports streaming environment described in recent news.

This stock has shown a change of -12.88% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.