China SXT Pharmaceuticals, Inc. (SXTC)

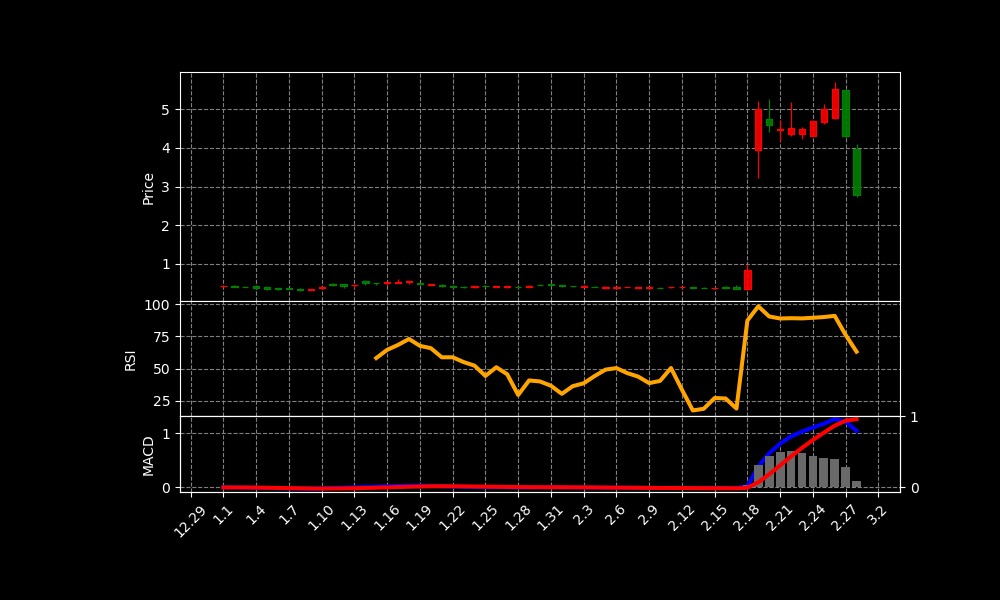

SXTC Chart as of 2025-03-10

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 75 |

| Address: | 178 North Taidong Road, Taizhou, China |

| Country: | China |

| Website: | https://www.sxtchina.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 2.7699999809265137 USD |

| Today Change: | -30.23% |

| Outstanding Shares: | 507,804 |

| Volume: | 161,771 |

| Avg Volume: | 1,173,958 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | 2023-10-05 |

| Last Split Factor: | 1:25 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Feng Zhou | Chairman of the Board & Co-CEO | 50k | — |

| Mr. Xiaodong Pan | Chief Financial Officer | 50k | — |

| Mr. Jun Zheng | Executive Director | — | — |

| Mr. Sze Beng Lim | Co-Chief Executive Officer | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 1,928,497 |

| Cost Of Revenue | 1,374,526 |

| Gross Profit | 553,971 |

| Operating Income | -2,515,217 |

| Net Income | -3,098,532 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 23,127,057 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0001213900-25-006976 | 2025-01-27 | China SXT Pharma (SXTC) entered a securities purchase agreement (PIPE) on Jan 21, 2025, selling 14.2M shares at $0.20/share, plus warrants. Proceeds (~$2.84M) are for working capital. Some PIPE investors surrendered $1.84M in debt under a separate loan agreement. |

| 0001213900-25-005977 | 2025-01-23 | China SXT Pharmaceuticals reported (Jan 2025) Director Songfan He resigned. Yong Lip Chee was appointed independent director and audit committee chairman. Simon Lim Sze Beng was appointed Co-CEO, Feng Zhou also Co-CEO. |

| 0001851416-25-000004 | 2025-01-21 | This SEC filing text defines CSS styles for text boxes and tables. It specifies borders, padding, font sizes, colors, and alignment for different table elements (table, th, td). |

| 9999999995-24-003364 | 2024-11-04 | China SXT Pharmaceuticals’ F-3 filing (333-282776) was declared effective by the SEC on November 4, 2024, at 5:00 PM. CIK: 0001723980. |

| 0001213900-24-093185 | 2024-11-01 | China SXT Pharmaceuticals requests SEC acceleration of Form F-3 registration (File No. 333-282776) to be effective at 5:00 p.m. ET on November 4, 2024, or soon after. |

News Summary

No news from NewsAPI

Analysis of Today’s Move

China SXT Pharmaceuticals (SXTC) likely experienced a stock price decline today. The primary driver is the newly announced PIPE (Private Investment in Public Equity) agreement. This agreement involves selling a substantial number of shares. Selling 14.2 million shares at $0.20 per share significantly dilutes existing shareholders. This dilution typically leads to a decrease in the stock’s value.

The PIPE financing, although providing working capital, signals potential financial distress. The company is raising approximately $2.84 million through this offering. Part of this deal includes some investors surrendering $1.84 million in existing debt. This suggests the company needed this capital injection to alleviate debt pressures.

Furthermore, recent management changes could contribute to investor uncertainty. The resignation of Director Songfan He is a noteworthy event. The appointment of Yong Lip Chee and Simon Lim Sze Beng also brings changes. These shifts, particularly appointing co-CEOs, can raise questions about strategic direction.

The absence of news outside of SEC filings reinforces the interpretation. No positive external catalysts appeared to offset the negative impact. The market likely focused on the dilution and management restructuring. The SEC filings became the only source of information.

Therefore, the stock decrease is primarily attributed to shareholder dilution. The PIPE offering, combined with management changes, created negative sentiment. Investors likely reacted to the dilution, fearing a decrease in their holdings’ value. This illustrates the impact of corporate actions on stock performance.

This stock has shown a change of -30.23% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.