Healthcare Triangle, Inc. (HCTI)

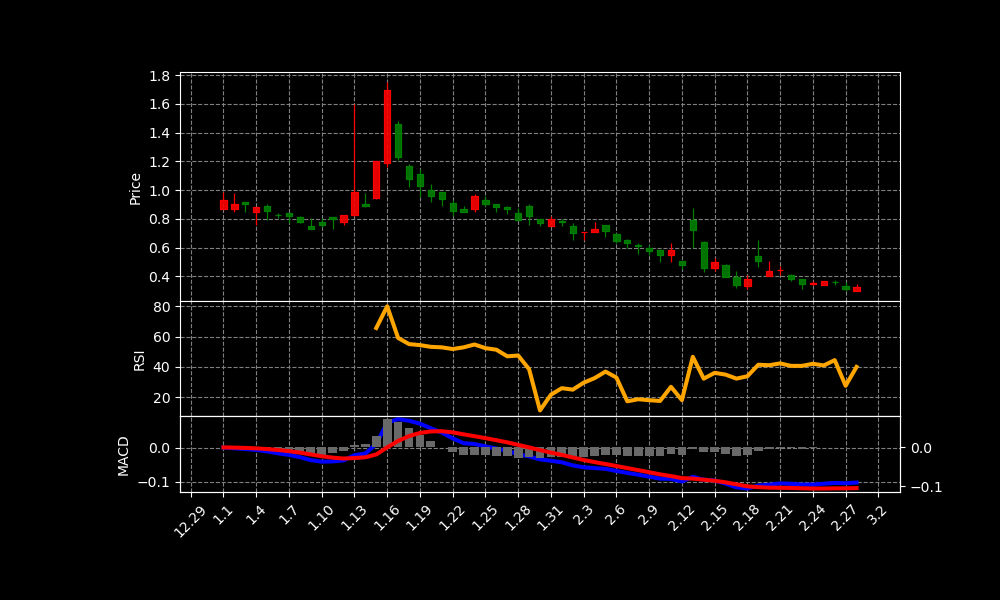

HCTI Chart as of 2025-03-12

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 22 |

| Address: | 7901 Stoneridge Drive, Pleasanton, CA, United States |

| Country: | United States |

| Website: | https://www.healthcaretriangle.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 0.513 USD |

| Today Change: | 57.85% |

| Outstanding Shares: | 6,401,820 |

| Volume: | 13,151,302 |

| Avg Volume: | 3,563,205 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | 2023-05-26 |

| Last Split Factor: | 1:10 |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Thyagarajan Ramachandran | Chief Financial Officer | 267.5k | — |

| Mr. Shibu Kizhakevilayil | Head of M&A and Director | 229.88k | — |

| Mr. Chris Paalman | Director of Engineering & Operations | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 33,203,000 |

| Cost Of Revenue | 26,426,000 |

| Gross Profit | 6,777,000 |

| Operating Income | -11,348,000 |

| Net Income | -12,339,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 10,049,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

| AccNo | Date | Summary |

|---|---|---|

| 0002059578-25-000001 | 2025-03-07 | CSS styling for tables and textboxes, defining borders, fonts, colors, and alignment. Specifically configures appearance for SEC filings. |

| 0001213900-25-021346 | 2025-03-07 | Healthcare Triangle’s definitive proxy statement for the 2025 annual meeting. Stockholders will vote on director elections, an amendment to the 2020 Stock Incentive Plan, and ratification of M&K CPAS, PLLC as auditor. The board recommends voting FOR all proposals. Meeting is virtual. |

| 0001213900-25-020571 | 2025-03-05 | Healthcare Triangle’s majority stockholders approved a reverse stock split (1:2 to 1:250), increased authorized shares (110M to 1.01B), and authorized warrant issuance. This PRE 14C informs stockholders; no proxy needed. Actions effective 20 days after filing. |

| 0001213900-25-018926 | 2025-03-03 | Healthcare Triangle (HCTI) filed an 8-K on 2/27/25. They entered into agreements for a private placement of units with warrants to purchase common stock. Offering price was $0.42/unit. Stockholder approval is needed for warrant exercise. |

| 0001213900-25-017578 | 2025-02-27 | Healthcare Triangle (HCTI) received notice from Nasdaq on Feb 26, 2025, that its stock price was below $1.00 for 30 days, risking delisting. HCTI has until Aug 25, 2025, to regain compliance. Previously, HCTI was notified about a stockholders’ equity deficiency. |

News Summary

– Spartan Capital Securities, LLC Announces Key February Transactions

2025-03-07 21:56:00 | GlobeNewswire

New York, NY, March 07, 2025 (GLOBE NEWSWIRE) — Spartan Capital Securities, LLC, a full-service investment banking firm, is pleased to announce a series of strategic transactions completed in February 2025, reinforcing its position as a trusted financial par…

Link

Analysis of Today’s Move

Healthcare Triangle (HCTI) likely experienced a stock rally today due to a combination of factors surrounding recent news. Spartan Capital Securities’ announcement of successful February transactions may have indirectly boosted investor confidence. Positive sentiment towards the investment banking firm could spill over into companies they support. However, directly attributing the rally solely to this announcement is improbable.

The SEC filings paint a more complex picture of the situation with HCTI specifically. The approval of a reverse stock split by majority stockholders suggests an attempt to regain Nasdaq compliance. This move, alongside increasing authorized shares and authorizing warrant issuance, aims to improve the company’s financial position. Such actions, even if potentially dilutive long-term, are often initially perceived positively by investors.

The upcoming vote on director elections and the 2020 Stock Incentive Plan amendment could also play a minor role. The board’s recommendation to vote FOR all proposals likely signals stability. Furthermore, the ratification of M&K CPAS, PLLC as auditor suggests proper financial oversight. These factors contribute to a perception of competent management.

The private placement of units with warrants priced at $0.42 is also relevant. While stockholder approval is needed for warrant exercise, the capital injection is generally seen as beneficial. The offering likely provides HCTI with necessary funding for future operations. This additional capital infusion can boost investor confidence.

Finally, the Nasdaq delisting warning notice from February 26th is crucial context. The company’s actions, including the reverse stock split, are directly aimed at addressing this issue. If investors believe HCTI has a viable plan to regain compliance, it can lead to increased buying pressure. Therefore, the rally could reflect optimism about the company’s future prospects.

This stock has shown a change of 57.85% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.