LZ Technology Holdings Limited Class B Ordinary Shares (LZMH)

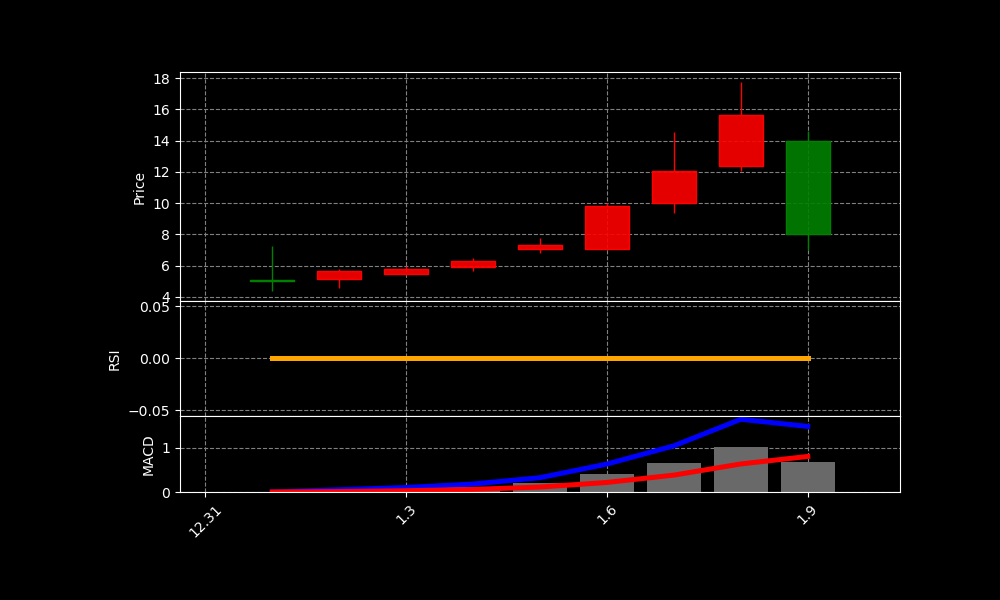

LZMH Chart as of 2025-03-11

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | 67 |

| Address: | No. 5999 Wuxing Avenue, Zhili Town, Huzhou, China |

| Country: | China |

| Website: | https://lz-qs.com |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 8.0 USD |

| Today Change: | -42.86% |

| Outstanding Shares: | 129,300,000 |

| Volume: | 682,612 |

| Avg Volume: | 892,687 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

| Name | Title | Pay | Year |

|---|---|---|---|

| Mr. Runzhe Zhang | CEO & Director | — | — |

| Ms. Weihua Chen | Chief Financial Officer | — | — |

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 568,865,000 |

| Cost Of Revenue | 537,609,000 |

| Gross Profit | 31,256,000 |

| Operating Income | -6,439,000 |

| Net Income | -6,209,000 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 286,139,000 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– Why LZ Technology Holdings Limited Class B Ordinary Shares (LZMH) Soared Last Week

2025-03-09 22:47:20 | Yahoo Entertainment

– LZ Technology Holdings (LZMH) Plans to Raise $9 Million in February 27th IPO

2025-02-15 06:14:49 | ETF Daily News

LZ Technology Holdings (LZMH) plans to raise $9 million in an initial public offering (IPO) on February 27th. The company will be issuing 1,800,000 shares at a price of $4.00-$6.00 per share. In the last 12 months, LZ Technology H…

Link

– LZ Technology Holdings Limited Announces Pricing of Initial Public Offering

2025-02-27 01:00:00 | GlobeNewswire

HUZHOU, China, Feb. 26, 2025 (GLOBE NEWSWIRE) — LZ Technology Holdings Limited (“LZ Technology” or the “Company”), an information technology and advertising company, today announced the pricing of its initial public offering of 1,800,000 Class B ordinary sha…

Link

Analysis of Today’s Move

**LZ Technology Holdings (LZMH) Stock Decline Analysis**

LZ Technology Holdings (LZMH) experienced a stock decline today. It is likely the result of a correction after last week’s surge. The surge may have been driven by speculative trading. This type of volatility is common after an IPO. Remember, the IPO was priced on February 27th.

The company recently completed its initial public offering. LZ Technology planned to raise $9 million through the offering. They issued 1,800,000 shares to the public. The initial price range was $4.00 to $6.00 per share.

Without specific SEC filings, a deeper investigation is difficult. We are unable to see detailed financial statements. Analyst ratings and institutional ownership data remain unknown. This makes identifying concrete reasons for the drop harder.

The news articles suggest a volatile stock. The recent increase contrasts with today’s drop. Such fluctuations can be triggered by various factors. Market sentiment and broader economic trends could also be contributing.

Ultimately, investors should exercise caution. Due diligence is crucial before investing in newly public companies. Keep an eye on financial releases and industry news. Monitor LZ Technology for future updates.

This stock has shown a change of -42.86% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.