MKDWELL Tech Inc. (MKDW)

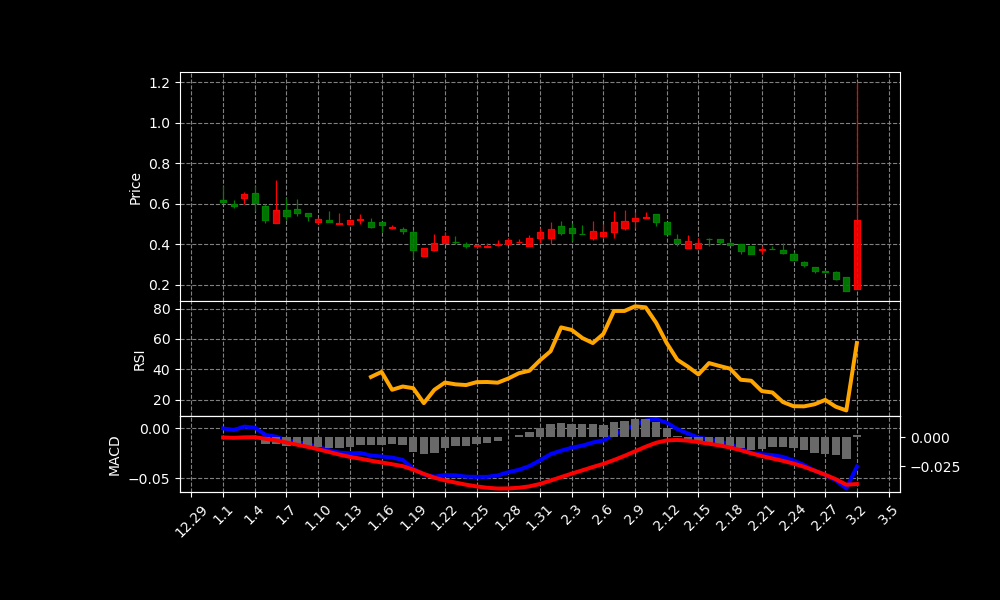

MKDW Chart as of 2025-04-07

Stock Information

| CEO: | – |

| CFO: | – |

| Employees: | – |

| Address: | -, – |

| Country: | – |

| Website: | – |

| Listing Date: | – |

| Founded: | – |

| Founder: | – |

| Current Price: | 0.5199999809265137 USD |

| Today Change: | 188.89% |

| Outstanding Shares: | 18,588,300 |

| Volume: | 222,490,125 |

| Avg Volume: | 174,065 |

| Expert Target Price: | – (Institutions: 0) |

| EPS: | – |

| PER: | – |

| Dividend Date: | – |

| Last Split Date: | – |

| Last Split Factor: | – |

Key Executives

–

Financials

Income Statement

| Metric | Amount |

|---|---|

| Total Revenue | 3,670,722 |

| Cost Of Revenue | 2,996,990 |

| Gross Profit | 673,732 |

| Operating Income | -1,839,857 |

| Net Income | -1,589,628 |

Balance Sheet

| Metric | Amount |

|---|---|

| Total Assets | 9,171,004 |

| Total Liabilities | – |

| Total Stockholder Equity | – |

Cash Flow

| Metric | Amount |

|---|---|

| Total Cash From Operating Activities | – |

| Capital Expenditures | – |

SEC Filings (Gemini Summaries)

SEC Filings: No CIK found

News Summary

– Virtu Financial LLC Grows Stock Position in MKDWELL Tech Inc. (NASDAQ:MKDW)

2025-03-30 08:24:58 | ETF Daily News

Virtu Financial LLC increased its holdings in MKDWELL Tech Inc. (NASDAQ:MKDW – Free Report) by 1,111.0% during the fourth quarter, HoldingsChannel.com reports. The institutional investor owned 161,299 shares of the company’s stock after acquiring an additiona…

Link

Analysis of Today’s Move

MKDW stock experienced a notable rally today, likely driven by increased investor confidence. The primary catalyst appears to be Virtu Financial’s significantly increased stake. Virtu Financial LLC expanded its MKDW holdings by an impressive 1,111% in Q4. This substantial increase suggests a strong belief in MKDW’s future prospects. Such institutional investment often signals positive sentiment.

The news of Virtu’s investment is circulating widely. This news is likely prompting other investors to take notice. Increased buying pressure typically leads to stock price appreciation. This explains today’s positive movement in MKDW’s share value.

Despite the absence of specific CIK filings, the core information from the news summary strongly suggests a correlation. Institutional buying often serves as a validation of a company’s potential. This fuels further demand and drives the stock upwards. Therefore, Virtu’s increased position is the most probable explanation for the rally.

This stock has shown a change of 188.89% today.

Please consider that all investment decisions carry risk;

none of the content here should be construed as financial advice.

Always do your own research or consult a professional before making investment decisions.

The information provided in this article is for informational purposes only

and does not constitute legal, tax, or investment advice.

Investing involves risk, including the potential loss of principal.